Doji Candlestick Pattern: A Guide To Understanding And Trading The Doji

Editor's Notes: "Doji Candlestick Pattern: A Guide To Understanding And Trading The Doji" have published today 25th May 2023, as Doji candlesticks are distinctive and merit particular attention. Understanding their significance can contribute to enhanced trading strategies.

Our objective in presenting this guide is to equip traders with the knowledge and insights necessary to effectively identify and interpret Doji patterns within the context of their trading strategies. Through diligent analysis and assimilation of pertinent information, we have endeavored to craft a comprehensive resource that empowers traders to make informed decisions and improve their trading outcomes

Key differences or Key takeways:

| Understanding Doji Patterns | Trading Strategies |

|---|---|

| - Doji patterns' unique characteristics | - Strategies for trading Doji patterns |

| - Identifying different types of Doji patterns | - Risk management techniques |

| - Psychological implications of Doji patterns | - Case studies of successful Doji trades |

Exploring the Doji Candlestick Pattern: A Journey into Technical Analysis

FAQ

Addressing the most frequent queries about the Doji Candlestick Pattern:

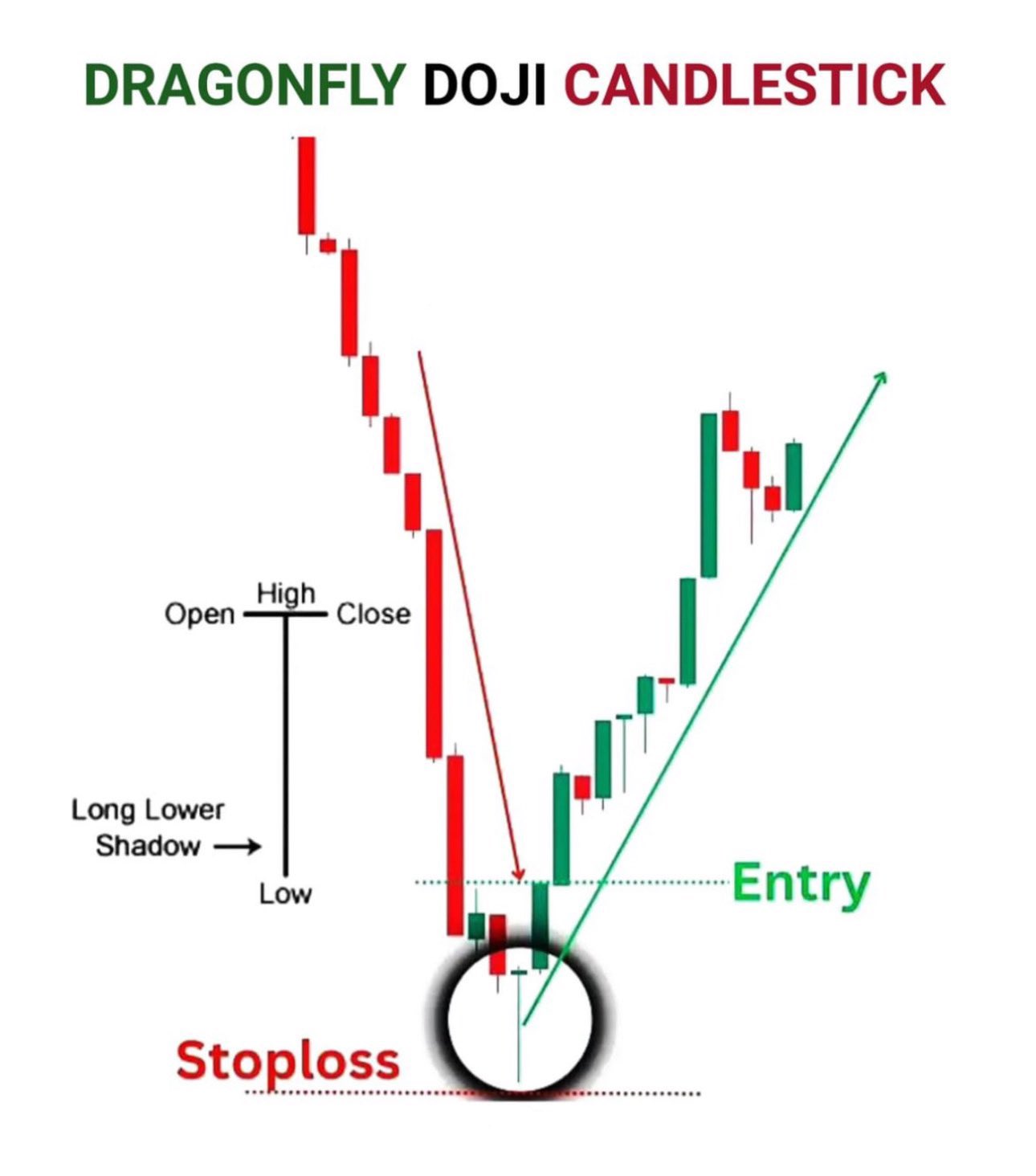

Dragonfly Doji Candlestick Pattern | Hot Sex Picture - Source www.hotzxgirl.com

Question 1: What differentiates a Doji candlestick pattern from other candlestick patterns?

The Doji candlestick pattern's defining characteristic is its small body, indicating little to no price change during the trading period. It signifies indecision or a stalemate between buyers and sellers.

Question 2: Are there different types of Doji candlestick patterns?

Yes, there are several types of Doji candlestick patterns, including the Long-legged Doji, Gravestone Doji, Dragonfly Doji, and Four-Price Doji. Each type provides unique insights into market sentiment.

Question 3: How do traders use the Doji candlestick pattern in technical analysis?

Traders utilize the Doji candlestick pattern to identify potential reversals, support, and resistance levels. It serves as an early warning sign of a possible change in market trend.

Question 4: Is the Doji candlestick pattern a reliable indicator?

While the Doji candlestick pattern can provide valuable insights, it should not be relied upon solely for trading decisions. Traders should consider the overall market context and utilize other technical indicators for confirmation.

Question 5: Can the Doji candlestick pattern appear in isolation?

No, the Doji candlestick pattern rarely occurs in isolation. It usually appears in conjunction with other candlestick patterns or technical indicators, providing a more comprehensive view of market dynamics.

Question 6: What are the limitations of the Doji candlestick pattern?

The Doji candlestick pattern can be subjective, as its interpretation depends on individual traders' perspectives. Additionally, it may not be as effective in volatile or rapidly changing markets.

In conclusion, the Doji candlestick pattern is a useful technical analysis tool that can provide insights into potential market reversals or indecision. However, it should be used in conjunction with other indicators for confirmation and a comprehensive understanding of market conditions.

Proceed to the next article section for further exploration of candlestick patterns.

Tips

Doji Candlestick Pattern: A Guide To Understanding And Trading The Doji is a widely recognized candlestick pattern that signals market indecision. Interpreting it correctly can assist in making informed trading decisions. Here are some tips to enhance your understanding:

Tip 1: Observe the context. The significance of a doji candlestick is influenced by the trend preceding it. For example, after an uptrend, a doji may suggest a potential reversal, while in a downtrend, it may indicate a pause or consolidation.

Tip 2: Consider volume. High volume accompanying a doji candlestick signifies a greater level of indecision and can intensify its significance. Conversely, low volume may indicate that the market lacks momentum.

Tip 3: Note the shadows. Long shadows on a doji candlestick imply significant price swings within the session, suggesting indecision and market volatility. Pay attention to the relationship between the shadows and the body of the candlestick.

Tip 4: Look for confirmation. A single doji candlestick is not always a reliable signal. Confirmation from additional technical indicators, such as moving averages or support/resistance levels, can increase the probability of a successful trade.

Tip 5: Trade with caution. Doji candlesticks signal market indecision, indicating the potential for trend reversals or consolidations. Exercise caution when making trades based solely on doji patterns, particularly if other technical indicators provide conflicting signals.

Summary: By incorporating these tips into your analysis, you can enhance your understanding of doji candlestick patterns and improve your trading decisions. Remember to consider the context, volume, shadows, confirmation, and trade with caution.

Doji Candlestick Pattern: A Guide To Understanding And Trading The Doji

The Doji candlestick pattern is a neutral pattern that indicates indecision in the market. It is characterized by a small body and long shadows, and it can appear in both bullish and bearish trends.

- Indecisive: Doji candlesticks indicate indecision in the market, as they show that neither buyers nor sellers are in control.

Doji candlesticks can be used to identify potential reversals in trend, and they can also be used to confirm existing trends. They are a versatile pattern that can be used by traders of all levels of experience.

Doji Candlestick Chart Pattern Candlestick Patterns Trading Charts - Source www.babezdoor.com

The Doji candlestick pattern is a neutral pattern that can indicate a reversal or continuation of the current trend. It is characterized by a small body with long upper and lower shadows, indicating that the opening and closing prices are nearly equal. Dojis can be bullish or bearish, depending on the context in which they appear.

Bearish Evening doji star candlestick pattern PDF Guide - Trading PDF - Source tradingpdf.net

Bullish dojis typically occur at the bottom of a downtrend and signal a potential reversal to the upside. Bearish dojis typically occur at the top of an uptrend and signal a potential reversal to the downside.

Dojis can also be used to identify potential support and resistance levels. A doji that forms at a support level may indicate that the support level is holding and that the price is likely to bounce back up. A doji that forms at a resistance level may indicate that the resistance level is too strong for the price to break through and that the price is likely to fall back down.

Dojis are a versatile candlestick pattern that can be used to identify potential reversals, continuations, and support and resistance levels. By understanding the different types of dojis and how to interpret them, traders can gain an edge in the markets.

Here are some additional tips for trading dojis:

- Dojis are most reliable when they occur in the context of a trend.

- Bullish dojis are more reliable than bearish dojis.

- Dojis should be confirmed by other technical indicators before making a trading decision.