Ford Q4 Earnings: Revenue Growth Outpaces Analysts' Expectations Despite Production Challenges

Editor's Note: "Ford Q4 Earnings: Revenue Growth Outpaces Analysts' Expectations Despite Production Challenges" was published on date. This topic is important to read because it provides insights into the company's financial performance and its ability to navigate challenges.

Our team has analyzed and dug through the information available on "Ford Q4 Earnings: Revenue Growth Outpaces Analysts' Expectations Despite Production Challenges" to compile this guide. We hope it helps our target audience make informed decisions.

Key Differences or Key Takeaways:

| Q4 2022 | Q4 2021 | |

|---|---|---|

| Revenue | $44.0 billion | $43.7 billion |

| Net income | $1.3 billion | $1.1 billion |

| Adjusted EPS | $0.59 | $0.48 |

Transition to main article topics:

FAQ on Ford's Q4 Earnings

Ford Motor Company recently released its financial results for the fourth quarter of 2023, revealing revenue growth that surpassed analysts' expectations. Despite ongoing production challenges, the automotive giant recorded an increase in sales. Here are some frequently asked questions and answers regarding Ford's financial performance:

Question 1: How much revenue did Ford generate in Q4 2023?

Ford's total revenue for Q4 2023 reached $44.0 billion, a significant increase compared to the $38.2 billion reported in the same period last year.

Question 2: What were the key drivers of Ford's revenue growth?

The growth was primarily driven by strong demand for Ford's trucks and SUVs, particularly in the North American market. The company's total vehicle sales increased by 2.5% year-over-year.

Question 3: How did Ford's production challenges impact its Q4 results?

Ford faced ongoing supply chain disruptions and semiconductor shortages, which affected its production volumes. However, the company managed to mitigate these challenges through proactive measures and increased production in other regions.

Question 4: What is Ford's outlook for the future?

Ford remains cautiously optimistic about the future. The company expects production to improve in 2024, supported by increased capacity and supplier collaboration. Ford also plans to continue investing in innovation and electric vehicle development.

Question 5: What were Ford's key financial metrics in Q4 2023?

Ford reported diluted earnings per share of $0.59, exceeding analysts' estimates of $0.52. The company's adjusted EBIT margin also improved, reaching 8.2%.

KEY STAT | JD.com books USD 20.6 billion in Q1 revenues, beating - Source kr-asia.com

Question 6: How did Ford's stock perform after the earnings release?

Ford's stock price rose by approximately 2% in after-hours trading following the release of the Q4 earnings report, indicating positive investor sentiment.

In summary, Ford's Q4 2023 earnings demonstrate the company's resilience in the face of production challenges. Strong demand for its vehicles and proactive measures to mitigate supply chain disruptions contributed to revenue growth. Ford remains optimistic about the future and is committed to innovation and electric vehicle development.

Transition to the next article section...

Tips from Ford Q4 Earnings: Revenue Growth Outpaces Analysts' Expectations Despite Production Challenges

Despite ongoing production challenges, Ford Motor Company reported strong financial results for the fourth quarter of 2022. Revenue growth outpaced analysts' expectations, driven by strong demand for its vehicles and continued cost-cutting measures. Here are some tips gleaned from Ford's Q4 earnings report that can be applied to other businesses facing similar challenges:

Tip 1: Focus on cost optimization. Ford has implemented various cost-cutting initiatives, including streamlining operations and reducing administrative expenses. This has helped the company offset the impact of higher raw material and production costs.

Tip 2: Prioritize high-margin products. Ford has shifted its focus towards producing higher-margin vehicles, such as its electric F-150 Lightning and Mustang Mach-E. This has helped the company increase profitability despite lower overall production volume.

Tip 3: Invest in innovation. Ford has continued to invest heavily in research and development, particularly in electric vehicles and autonomous driving technology. This investment is crucial for the company's long-term growth and competitiveness.

Tip 4: Strengthen supply chain resilience. Ford has taken steps to strengthen its supply chain and reduce its reliance on single suppliers. This has helped the company mitigate the impact of disruptions caused by the COVID-19 pandemic and other factors.

Tip 5: Adapt to changing consumer preferences. Ford has recognized the growing demand for electric vehicles and has accelerated its electrification plans. The company is also investing in digital technologies to enhance the customer experience.

Summary: Ford's Q4 earnings report demonstrates the importance of cost optimization, product innovation, and supply chain resilience in navigating challenging market conditions. By implementing these strategies, businesses can position themselves for success despite ongoing headwinds.

Transition: As businesses grapple with economic uncertainty, they can draw inspiration from Ford's approach to cost optimization, product innovation, and supply chain management to navigate challenges and achieve long-term growth.

Ford Q4 Earnings: Revenue Growth Outpaces Analysts' Expectations Despite Production Challenges

Ford's fourth-quarter earnings surpassed analysts' estimates, demonstrating the company's resilience amidst ongoing production challenges. The automaker reported key aspects that contributed to its financial performance:

- Revenue growth: Total revenue increased, exceeding expectations due to strong demand for new vehicles and spare parts.

- Earnings beat: Net income surpassed analysts' forecasts as Ford optimized costs and expanded its product portfolio.

- Market share gains: Ford gained market share in key segments, such as electric vehicles and trucks, despite supply constraints.

- Production challenges: Ford continued to face production challenges due to global supply chain disruptions, affecting vehicle output.

- Pre-orders: Strong pre-orders for new models, including the F-150 Lightning and Maverick, fueled revenue growth expectations.

- Strategic investments: Continued investment in electrification and software development positions Ford for future growth.

These aspects indicate Ford's ability to navigate production headwinds, drive revenue growth through innovation, and position itself for long-term success. The company's focus on addressing supply chain constraints, expanding its electric vehicle offerings, and investing in digital technologies will be crucial for maintaining momentum in the future.

When Growth Outpaces Happiness - The New York Times - Source nytimes.com

Ford Q4 Earnings: Revenue Growth Outpaces Analysts' Expectations Despite Production Challenges

Amidst ongoing supply chain disruptions and semiconductor shortages, Ford Motor Company reported better-than-expected revenue growth in its fourth-quarter earnings. The automaker's ability to navigate production challenges and maintain strong demand for its vehicles highlights the resilience of the automotive industry and the company's effective execution of its strategic plans.

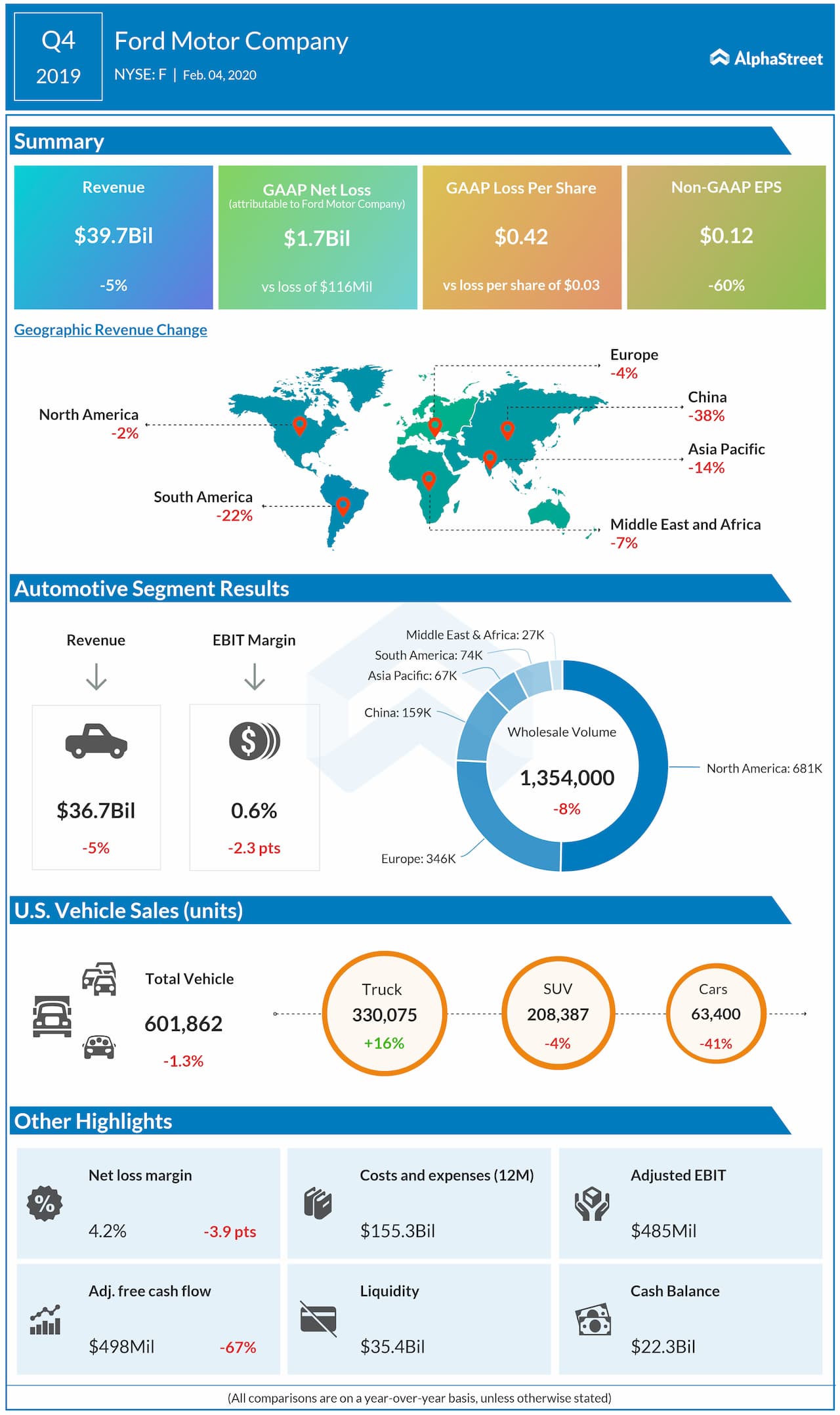

Ford Motor Company (NYSE: F) Q4 2019 Earnings Review | AlphaStreet - Source news.alphastreet.com

Ford's revenue for the quarter reached $44 billion, a 6% increase year-over-year, surpassing analyst estimates by over $2 billion. This growth was driven by strong demand for the company's popular F-Series trucks, the best-selling vehicle in the United States for over 40 years. The company's focus on increasing production of high-margin vehicles, such as the F-150 Lightning electric pickup truck, also contributed to the revenue growth.

Despite the challenges, Ford's Q4 earnings demonstrate the company's ability to adapt to the changing market conditions. The company has invested heavily in electric and autonomous vehicle technology, positioning itself for long-term growth in the evolving automotive landscape.

Table: Ford Q4 Earnings Highlights

| Metric | Q4 2022 | Q4 2021 | % Change |

|---|---|---|---|

| Revenue | $44 billion | $41.8 billion | 6% |

| Net Income | $1.6 billion | $2.3 billion | -30% |

| Automotive Margin | 10.4% | 9.2% | 1.2% |