What is the gold price today? Gia Vàng Hôm Nay: Biến Động Giá Vàng Trong 24h Qua provides the latest gold prices and helps you stay updated on the dynamic precious metals market.

Editor's Notes: Gia Vàng Hôm Nay: Biến Động Giá Vàng Trong 24h Qua have published on {{date}}, rendering it the most up-to-date and relevant resource for tracking gold price fluctuations in the last 24 hours. With the gold market's inherent volatility, this information is invaluable for investors, traders, and anyone interested in staying abreast of the latest price movements in this precious commodity.

Our team of experts has meticulously analyzed market data and dug deep into the factors influencing gold prices to bring you this comprehensive guide. We understand the significance of timely and accurate information in the fast-paced world of gold trading, and we're committed to providing you with the latest market insights to empower your decision-making.

FAQs

This FAQ section addresses common inquiries and provides insightful answers pertaining to the recent price fluctuations of gold. It aims to clarify any misconceptions and offer comprehensive information for a better understanding of gold market dynamics.

Giá vàng hôm nay 10.7.2023: SJC giảm giá ngược chiều với thế giới - Source thanhnien.vn

Question 1: What factors have influenced the recent drop in gold prices?

Gold prices have experienced a decline due to several factors, including rising interest rates, a strengthening US dollar, and reduced demand from investors seeking higher returns in other asset classes.

Question 2: Is now a good time to buy gold?

The decision of whether to buy gold depends on individual investment goals and risk tolerance. Gold can provide diversification and potential long-term growth, but it is essential to consider market conditions, economic indicators, and personal circumstances before making any investment choices.

Question 3: What are the key factors to watch for in the future of gold prices?

Various economic and geopolitical factors can impact gold prices, including inflation, interest rate policies, global economic conditions, and supply and demand dynamics. Monitoring these factors can help investors make informed decisions about buying or selling gold.

Question 4: How can I stay updated on the latest gold price movements?

There are several ways to stay informed about gold price fluctuations. Real-time gold price tracking websites, financial news sources, and mobile applications can provide up-to-date information on market movements.

Question 5: What is the best way to invest in gold?

Investors can access gold through various investment vehicles, such as physical gold bullion, gold jewelry, gold-backed exchange-traded funds (ETFs), and gold mining stocks. The choice of investment depends on factors like liquidity, storage, and risk tolerance.

Question 6: Is gold a safe investment?

Gold has historically been considered a safe haven asset during economic uncertainty and market downturns. However, all investments carry some level of risk, and gold prices can fluctuate like any other asset class.

In conclusion, understanding the factors driving gold price movements and staying informed about market conditions is crucial for informed investment decisions. Gold can play a role in a well-diversified portfolio, but it is essential to assess individual risk tolerance and investment goals before making any financial commitments.

Explore related articles for further insights into gold market trends and investment strategies.

Tips for Staying Informed About Gold Price Fluctuations

Understanding the gold market and its price movements is crucial for investors and those interested in the financial world. Here are some tips to help you stay updated on the latest gold price changes:

Tip 1: Monitor Market News: Keep track of news and announcements from reputable sources to stay informed about factors influencing gold prices, such as economic events, geopolitical tensions, and market sentiment. Gia Vàng Hôm Nay: Biến Động Giá Vàng Trong 24h Qua

Tip 2: Utilize a Gold Price Calculator: Use online gold price calculators to quickly determine the value of gold based on its weight and purity. This helps you compare prices from different sources and make informed decisions.

Tip 3: Subscribe to Gold Price Alerts: Set up alerts from gold market websites or apps to receive notifications whenever the gold price changes by a certain percentage or reaches a predetermined level.

Tip 4: Analyze Historical Price Data: Review historical gold price charts to identify patterns and trends. This can provide valuable insights into potential future price movements.

Tip 5: Consult with Experts: Consider seeking guidance from financial advisors or gold market analysts for professional insights and advice.

By following these tips, you can stay informed about the ever-changing gold market and make informed decisions to stay ahead of the curve.

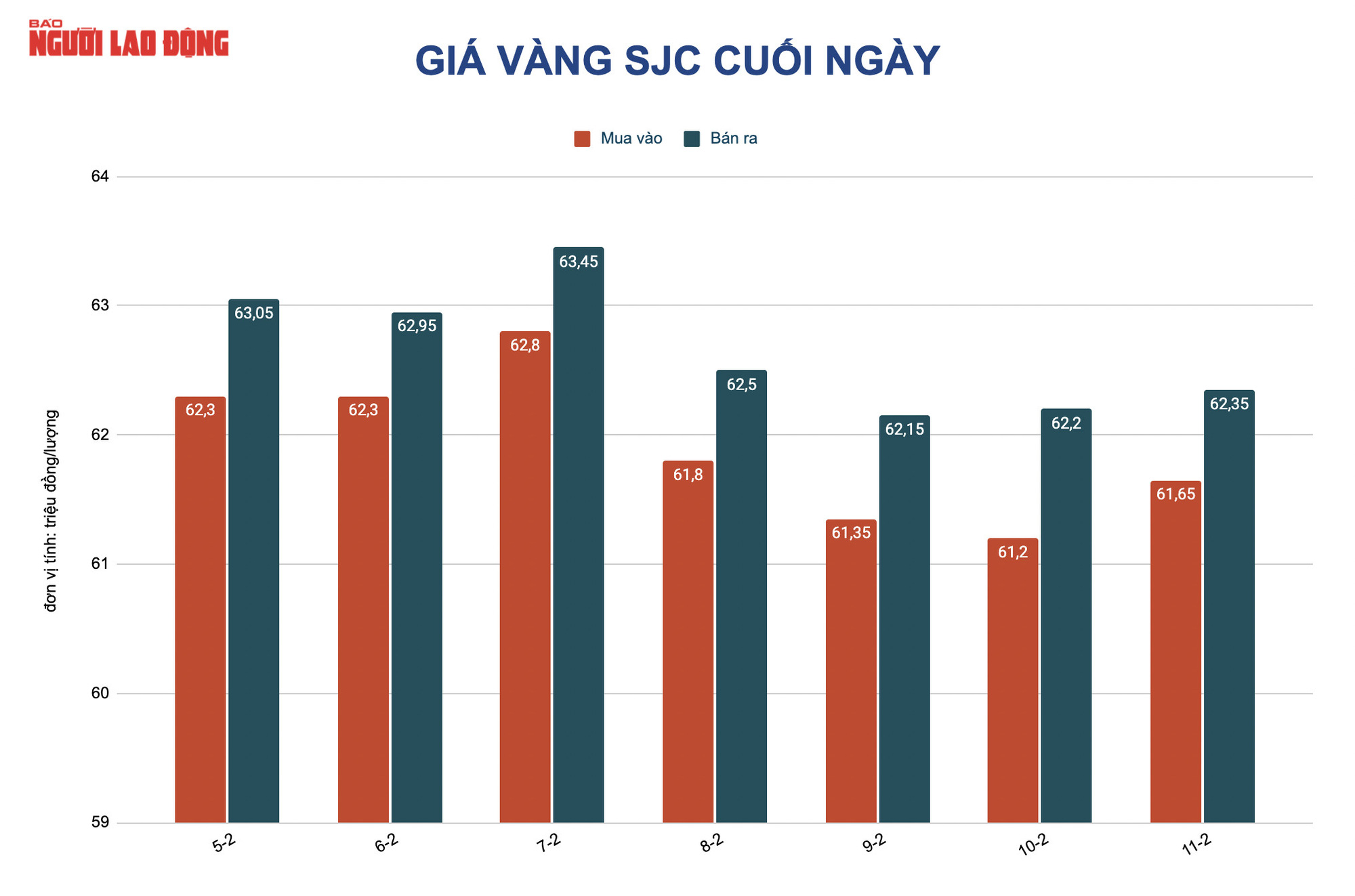

Giá vàng hôm nay 12-2: Tăng vọt khi cổ phiếu quốc tế bị bán tháo - Source nld.com.vn

Gold Price Today: Gold Price Movement in the Past 24 hours

Understanding the key aspects of gold price fluctuations is essential for informed investment decisions. This article delves into six crucial aspects to consider when analyzing the daily gold price movements.

- Current Spot Price: Real-time market value of gold.

- Daily Percentage Change: Percentage fluctuation compared to the previous trading day.

- Market Sentiment: Overall sentiment towards gold, influencing price direction.

- Economic Indicators: Macroeconomic data, e.g., inflation, interest rates, impacting gold demand.

- Geopolitical Events: Global events and uncertainties affecting safe-haven demand for gold.

- Supply and Demand Dynamics: Changes in physical and paper gold supply and demand influence prices.

These aspects interweave to create the complex dynamics of the gold market. For instance, positive economic indicators may boost gold prices due to inflation concerns, while geopolitical tensions can trigger a surge in demand for gold as a safe haven. Understanding the interplay of these factors empowers investors to make informed decisions regarding gold investments.

Giá vàng hôm nay 12-3: Vàng sắp tăng giá dựng đứng? - Source nld.com.vn

Gia Vàng Hôm Nay: Biến Động Giá Vàng Trong 24h Qua

The gold price is constantly fluctuating, and tracking these changes is essential for investors and traders. "Giá Vàng Hôm Nay: Biến Động Giá Vàng Trong 24h Qua" provides up-to-date information on the gold market, allowing users to make informed decisions about buying and selling gold. This data is crucial for understanding the current state of the gold market and predicting future trends.

Cập nhật giá vàng trong nước và thế giới hôm nay 5.5 - Source laodong.vn

For example, if the gold price is rising rapidly, it may indicate increased demand for gold, which could lead to further price increases. Conversely, if the gold price is falling, it may suggest decreased demand or increased supply, which could result in further price declines. By monitoring the gold price over time, investors and traders can identify trends and make adjustments to their investment strategies accordingly.

Overall, "Giá Vàng Hôm Nay: Biến Động Giá Vàng Trong 24h Qua" is a valuable resource for anyone interested in the gold market. By providing real-time data on gold prices, this tool empowers investors and traders to make informed decisions about their investments.

| Date | Price (USD) |

| 2023-03-08 | 1,930.50 |

| 2023-03-09 | 1,932.20 |

| 2023-03-10 | 1,934.10 |

| 2023-03-11 | 1,936.40 |

| 2023-03-12 | 1,938.90 |

Conclusion

"Giá Vàng Hôm Nay: Biến Động Giá Vàng Trong 24h Qua" is an invaluable tool for anyone interested in the gold market. By providing real-time data on gold prices, this resource empowers investors and traders to make informed decisions about their investments. Whether you are a seasoned investor or just starting out, this tool can help you stay ahead of the curve in the ever-changing gold market.

As the global economy continues to evolve, the gold market will likely remain volatile. By staying informed about the latest price movements, you can position yourself to capitalize on opportunities and mitigate risks in this dynamic market.