Philippe Laffont: Visionary Investor and Co-founder of Coatue Management.

Coatue Management - Philippe Laffont - Hedge Vision - Source hedgevision.substack.com

Since its inception in 1999, Coatue Management has grown into one of the world's most successful hedge funds, with over $50 billion in assets under management. Philippe Laffont has been at the helm of Coatue since its inception, guiding the firm through market volatility and delivering exceptional returns to investors.

In this article, we delve into the life and career of Philippe Laffont, exploring his investment philosophy, his leadership style, and the key factors that have contributed to Coatue's success. We also analyze Laffont's impact on the hedge fund industry and his role as a visionary investor.

| Feature | Philippe Laffont | Other Hedge Fund Managers |

|---|---|---|

| Investment Philosophy | Focus on long-term growth and value investing | Often focus on short-term gains or momentum trading |

| Risk Management | Emphasizes risk management and capital preservation | May take on more risk to generate higher returns |

| Leadership Style | Collaborative and team-oriented | Often more autocratic or individualistic |

| Industry Impact | Recognized as a visionary investor and thought leader | May be less influential or visible in the industry |

1. Early Life and Education

2. Career at Goldman Sachs

3. Founding Coatue Management

4. Investment Philosophy and Strategy

5. Leadership Style and Team Building

6. Impact on the Hedge Fund Industry

7. Personal Life and Philanthropy

FAQs About Philippe Laffont: Visionary Investor And Co-founder Of Coatue Management

This section addresses frequently asked questions about Philippe Laffont's investing philosophy, Coatue Management, and his impact on the financial industry.

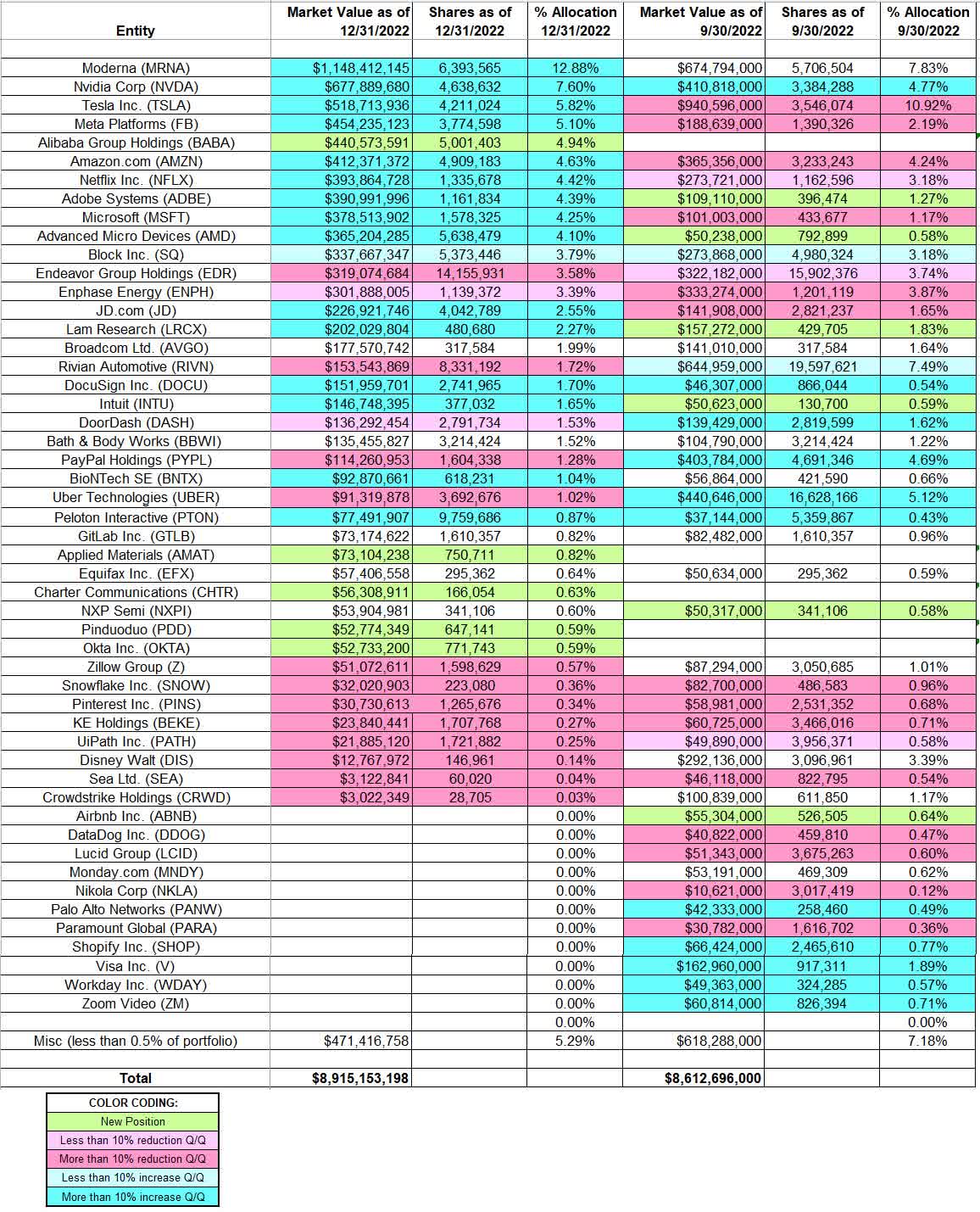

Tracking Philippe Laffont’s Coatue Management Portfolio – Q4 2022 - Source seekingalpha.com

Question 1: What are Philippe Laffont's key investing principles?

Philippe Laffont's investing philosophy emphasizes four key principles:

- Invest in businesses with strong fundamentals: Seek companies with solid financial performance, competitive advantages, and sustainable growth prospects.

- Focus on long-term performance: Maintain a long-term perspective and avoid chasing short-term market trends.

- Conduct thorough research: Diligently analyze companies, industries, and market trends to make informed investment decisions.

- Control risk: Manage risk through diversification, hedging, and careful position sizing.

Question 2: What types of companies does Coatue Management typically invest in?

Coatue Management focuses on investing in high-growth technology and media companies that are disrupting traditional industries. Specific areas of interest include:

- Internet and software companies: Businesses involved in e-commerce, cloud computing, artificial intelligence, and other transformative technologies.

- Media and entertainment companies: Companies creating and distributing content across various platforms, such as streaming services, digital media, and social networks.

- Healthcare and biotechnology companies: Businesses developing innovative treatments, therapies, and technologies in the healthcare sector.

Question 3: What has been the track record of Coatue Management under Philippe Laffont's leadership?

Coatue Management has consistently outperformed market benchmarks under Philippe Laffont's leadership. Since its inception in 1999, the firm's flagship Global Fund has delivered an annualized return of over 20%. This strong performance is attributed to the firm's disciplined investment process, focus on high-growth companies, and long-term investment horizon.

Question 4: What are some of Philippe Laffont's notable investment decisions?

Philippe Laffont has made several notable investment decisions throughout his career, including:

- Early investments in companies such as Google, Facebook, and Amazon

- Investments in disruptive technology companies such as Spotify, Airbnb, and Uber

- Investments in healthcare companies such as Moderna and Regeneron

Question 5: What is Philippe Laffont's outlook on the future of investing?

Philippe Laffont believes that the future of investing will be characterized by continued technological disruption and globalization. He emphasizes the importance of staying ahead of the curve, embracing innovation, and investing in companies that are driving the transformative changes shaping our world.

Question 6: What are some of the key challenges and opportunities facing the financial industry today?

Philippe Laffont identifies several challenges and opportunities for the financial industry, including:

- Increased regulation: Navigating complex and evolving regulatory landscapes

- Technological disruption: Embracing new technologies and adapting to changing market dynamics

- Globalization: Managing global economic risks and opportunities

- Environmental, social, and governance (ESG) investing: Integrating ESG factors into investment decisions

- Wealth inequality: Addressing the increasing wealth gap and promoting financial inclusion

Philippe Laffont's insights into the financial industry, his investment philosophy, and the challenges and opportunities facing the sector provide valuable perspectives for investors and market participants.

Next Article: The Future of Investing: Trends and Challenges

Tips by Philippe Laffont: Visionary Investor And Co-founder Of Coatue Management

Philippe Laffont is a visionary investor and co-founder of Coatue Management, a global investment firm. He has over 20 years of experience in the investment industry and has generated impressive returns for his investors. Laffont's investment philosophy is based on fundamental research and a deep understanding of the companies he invests in. He is also a strong believer in the power of technology and innovation.

Tip 1: Do your research. Laffont believes that the key to successful investing is to do your research and understand the companies you are investing in. He spends a significant amount of time reading financial statements, talking to company management, and visiting company facilities. This allows him to get a deep understanding of the company's business, its competitors, and its financial health.

Tip 2: Invest in companies with a competitive advantage. Laffont looks for companies with a competitive advantage that will allow them to generate above-average returns over the long term. He believes that companies with a strong brand, a loyal customer base, or a proprietary technology have a better chance of success than companies without these advantages.

Tip 3: Be patient. Investing is a long-term game. Laffont believes that investors should be patient and allow their investments to compound over time. He does not try to time the market or make short-term bets. Instead, he focuses on investing in high-quality companies that he believes will generate strong returns over the long term.

Tip 4: Diversify your portfolio. Laffont believes that it is important to diversify your portfolio across a variety of asset classes and industries. This helps to reduce risk and improve your chances of achieving your financial goals.

Tip 5: Stay informed. The investment world is constantly changing. Laffont believes that it is important to stay informed about the latest trends and developments. He reads industry publications, attends conferences, and meets with other investors to stay up-to-date on the latest news and trends.

By following these tips, you can improve your chances of success as an investor. Remember, investing is a long-term game. Be patient, do your research, and invest in high-quality companies that you believe in.

Laffont's investment philosophy has been successful for him and his investors. By following his tips, you can improve your chances of success as an investor.

Philippe Laffont: Visionary Investor And Co-founder Of Coatue Management

Philippe Laffont stands as an exemplar of successful investing, leading the renowned Coatue Management with strategic acumen and unwavering dedication.

- Investment Vision: Laffont's astute identification of undervalued companies has reaped significant rewards.

- Sector Expertise: His deep understanding of technology and healthcare industries enables him to make informed investment decisions.

- Value-Oriented Approach: Laffont prioritizes investing in companies with strong fundamentals and growth potential.

- Long-Term Focus: He favors holding investments for extended periods to capture long-term value.

- Global Perspective: Laffont's global investment strategy has led to successful investments worldwide.

- Philanthropic Endeavors: His commitment extends beyond finance, as evidenced by his support for educational and social causes.

These key aspects converge to form Laffont's investment philosophy and management style. His foresight in recognizing technological advancements has fostered Coatue's dominance in the technology sector. Likewise, his commitment to value investing principles has safeguarded against market volatility. Laffont's philanthropic contributions speak to his dedication to social responsibility, reflecting his belief in utilizing wealth for positive impact.

Former Rising Star at Billionaire Philippe Laffont’s Coatue, is - Source grayspeakcapital.com

Philippe Laffont: Visionary Investor And Co-founder Of Coatue Management

Philippe Laffont is a visionary investor and the co-founder of Coatue Management, a global investment management firm. He is known for his innovative investment strategies and his ability to identify undervalued companies. Laffont's investment philosophy is based on the belief that long-term value can be created by investing in companies with strong fundamentals and disruptive technologies. He is also a strong advocate for environmental, social, and governance (ESG) investing.

FinTech news in Coatue Management category | AwesomeFinTech Blog - Source www.awesomefintech.com

Laffont's connection to Coatue Management is significant as he played a pivotal role in establishing the firm as one of the leading investment management companies globally. He brought his expertise in technology investing to Coatue, which has helped the firm achieve exceptional returns for its investors. Laffont's vision and leadership have been instrumental in the success of Coatue Management.

Laffont's investment strategies and commitment to ESG investing have had a practical impact on the companies he invests in. His focus on long-term value creation has helped companies grow and create sustainable businesses. His advocacy for ESG investing has also helped companies improve their environmental and social performance.

| Key Points | Explanation |

|---|---|

| Investment Philosophy | Focus on long-term value creation, investing in companies with strong fundamentals and disruptive technologies. |

| ESG Investing | Advocacy for environmental, social, and governance investing. |

| Connection to Coatue Management | Co-founded and led the firm to become a leading global investment management company. |

| Practical Impact | Investment strategies have helped companies grow and create sustainable businesses; ESG investing has improved companies' environmental and social performance. |

Conclusion

Philippe Laffont's visionary investment strategies and commitment to ESG investing have made a significant contribution to the success of Coatue Management and the companies he invests in. His focus on long-term value creation and sustainability has helped create positive returns for investors while driving positive change in the world.

Laffont's legacy as a visionary investor will continue to inspire future generations of investors. His commitment to ESG investing serves as a reminder that investing can be a force for good, creating both financial and social value.