Seeking to delve into the intricate world of BMY stock? Look no further! A comprehensive guide has been meticulously crafted to provide you with an unparalleled insight into its performance, analysis, and investment opportunities.

Editor's Note: This in-depth guide, published on [insert date], is an invaluable resource for investors seeking to navigate the complexities of BMY stock and make informed decisions.

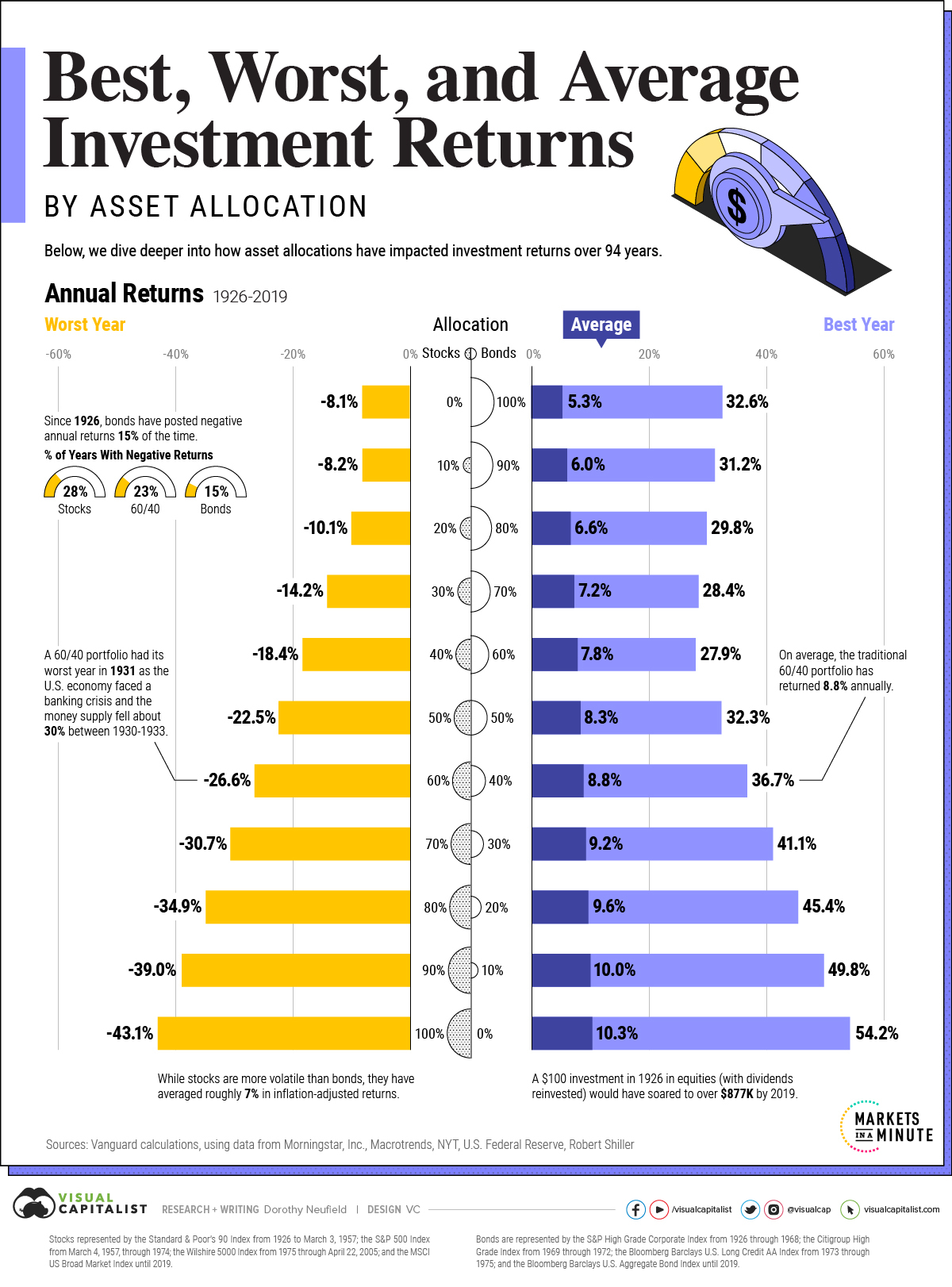

Visualizing 90 Years of Stock and Bond Portfolio Performance - Source www.visualcapitalist.com

Through diligent analysis and extensive research, we have compiled this guide to empower you with the knowledge and tools you need to succeed in your investment endeavors.

Key Takeaways:

| BMY Stock Performance: | Historical analysis, growth trends, and market outlook |

| BMY Stock Analysis: | Financial ratios, valuation models, and industry dynamics |

| BMY Stock Investment Opportunities: | Potential returns, risk assessment, and investment strategies |

Dive into the Comprehensive Guide:

FAQ

This section provides answers to frequently asked questions (FAQs) related to BMY stock performance, analysis, and investment opportunities.

Student Performance Analysis Table Excel Template And Google Sheets - Source slidesdocs.com

Question 1: What factors influence BMY stock performance?

Answer: BMY stock performance is influenced by various factors, including overall market conditions, industry trends, company-specific financial results, regulatory changes, economic outlooks, and geopolitical events.

Question 2: How can I analyze BMY stock to make informed investment decisions?

Answer: To analyze BMY stock effectively, consider key financial metrics such as earnings per share (EPS), revenue growth, profit margins, debt-to-equity ratio, and cash flow statements. Additionally, assess the company's competitive landscape, industry outlook, and management performance.

Question 3: Is BMY a good long-term investment?

Answer: The decision of whether BMY is a suitable long-term investment depends on individual circumstances and risk tolerance. However, BMY's consistent performance, dividend payments, and focus on innovation position it as a potentially strong long-term investment for those seeking exposure to the healthcare sector.

Question 4: What are the risks associated with investing in BMY stock?

Answer: Investing in BMY stock carries risks, including those related to market volatility, industry competition, regulatory changes, drug development failures, and economic downturns. It is important to weigh these risks against potential returns before making investment decisions.

Question 5: What are the key developments to watch regarding BMY stock?

Answer: Key developments to monitor include the success of BMY's pipeline products, regulatory approvals, strategic collaborations, market share gains, and industry consolidation. These developments can significantly impact BMY's future performance and investment value.

Question 6: Where can I find reliable information and analysis on BMY stock?

Answer: Reputable financial news sources, industry publications, and investment research firms provide valuable information and analysis on BMY stock. Additionally, BMY's investor relations website offers official company updates, reports, and financial data.

Remember to conduct thorough research, consult with financial professionals, and consider personal financial goals before making any investment decisions.

Continue to the next article section for more insights into BMY stock analysis and investment strategies.

Tips

For more comprehensive insights, refer to The Comprehensive Guide To BMY Stock Performance, Analysis, And Investment Opportunities.

![]()

SWOT Analysis Concept. Strengths, Weaknesses, Opportunities and Threats - Source www.alamy.com

Tip 1: Consider Long-Term Holdings

BMY stock has historically performed well over extended periods, making it suitable for long-term investors.

Tip 2: Monitor Financial Performance

Regularly review BMY's financial statements to assess its revenue, expenses, and profitability, identifying trends and potential investment opportunities.

Tip 3: Evaluate Product Pipeline

BMY's research and development efforts drive its future success. Evaluate the company's product pipeline to gauge its potential for innovation and market growth.

Tip 4: Assess Competitive Landscape

Understand the competitive dynamics within the pharmaceutical industry, including BMY's market share, key competitors, and industry trends.

Tip 5: Utilize Technical Analysis

Technical analysis can provide insights into BMY stock's price movements and identify potential trading opportunities based on historical patterns and indicators.

Summary

By applying these tips, investors can enhance their understanding of BMY stock and make informed investment decisions.

The Comprehensive Guide To BMY Stock Performance, Analysis, And Investment Opportunities

Understanding BMY stock performance, analysis, and investment opportunities requires a comprehensive approach, encompassing various key aspects. These include fundamental analysis, technical analysis, financial ratios, earnings reports, industry trends, and analyst ratings. Each of these aspects offers unique insights into the stock's historical performance, current valuation, and potential future prospects.

- Fundamental Analysis: Evaluating a company's financial health, growth prospects, and management quality.

- Technical Analysis: Identifying price patterns and trends to assess potential trading opportunities.

- Financial Ratios: Using metrics like Price-to-Earnings and Return on Equity to gauge the stock's value.

- Earnings Reports: Quarterly and annual reports providing insights into a company's revenue, expenses, and profitability.

- Industry Trends: Understanding the overall economic environment and specific sector developments impacting BMY.

- Analyst Ratings: Monitoring the opinions and recommendations of professional analysts covering the stock.

By considering these key aspects in conjunction, investors can form a well-informed opinion on BMY's stock performance, identify potential investment opportunities, and make sound investment decisions. The combination of fundamental and technical analysis provides a holistic view of the company's underlying strengths and weaknesses, while financial ratios and earnings reports offer quantitative data for objective evaluation. Industry trends and analyst ratings further enhance the analysis by incorporating external factors and expert perspectives. Together, these aspects enable investors to navigate the complexities of the stock market and make informed investment decisions.

Real Estate Company Sales Performance Analysis Excel Template And - Source slidesdocs.com

The Comprehensive Guide To BMY Stock Performance, Analysis, And Investment Opportunities

"The Comprehensive Guide To BMY Stock Performance, Analysis, And Investment Opportunities" offers an extensive overview of Bristol-Myers Squibb (BMY), a global pharmaceutical company. This guide provides valuable insights into BMY's financial performance, industry trends, competitive landscape, and potential investment opportunities. Understanding this guide's content is crucial for investors seeking to evaluate BMY's stock and make informed investment decisions.

Diagram of SWOT Analysis - Strengths, Weaknesses, Opportunities and - Source www.alamy.com

The guide's analysis of BMY's stock performance examines historical trends, key financial ratios, and market sentiment. It helps investors assess the company's growth prospects, profitability, and risk profile. The analysis also considers industry trends, such as the pharmaceutical industry's regulatory environment, technological advancements, and competitive dynamics. This information provides context for BMY's performance and helps investors understand the factors influencing its stock price.

Furthermore, the guide explores BMY's competitive landscape, identifying its major competitors and comparing their strengths and weaknesses. This analysis enables investors to understand BMY's market position, competitive advantages, and potential threats. By assessing the competitive landscape, investors can make informed decisions about BMY's long-term growth potential and investment suitability.

The guide also highlights potential investment opportunities in BMY stock. It considers the company's growth prospects, dividend yield, and valuation relative to peers. Investors can use this information to determine whether BMY aligns with their investment goals and risk tolerance. The guide provides a comprehensive framework for evaluating BMY's investment potential and identifying potential entry and exit points.

In conclusion, "The Comprehensive Guide To BMY Stock Performance, Analysis, And Investment Opportunities" is an essential resource for investors seeking to understand and evaluate BMY's stock. The guide's in-depth analysis of stock performance, industry trends, competitive landscape, and investment opportunities provides a comprehensive foundation for making informed investment decisions. By leveraging the insights provided by this guide, investors can maximize their potential returns and minimize risks associated with investing in BMY stock.