Buying a home is a major financial decision, and it's important to be aware of all the costs involved before you make an offer. One of the biggest expenses you'll face is closing costs, which can range from 2% to 5% of the purchase price of your home.

Editor's Notes: "WSBT Closing Costs: A Comprehensive Guide For Indiana Homebuyers" have published today date to provide homebuyers in Indiana with all the information they need to know about closing costs. This guide covers everything from what closing costs are to how to negotiate them.

WSBT Closing Costs: A Comprehensive Guide For Indiana Homebuyers put together this WSBT Closing Costs: A Comprehensive Guide For Indiana Homebuyers guide to help target audience make the right decision when it comes to buying a home. We've analyzed the different types of closing costs, dug into the details of each one, and provided tips on how to negotiate them. We've also included a comprehensive table that compares the different types of closing costs, so you can easily see what you're likely to pay.

Key differences or Key takeaways:

| Type of Closing Cost | What it is | How much it costs |

|---|---|---|

| Loan origination fee | A fee charged by the lender for processing your loan application | 0.5% to 1% of the loan amount |

| Appraisal fee | A fee charged by the lender for an appraisal of the home you're buying | $300 to $500 |

| Title insurance | Insurance that protects the lender against any claims against the title to the home | $1,000 to $2,000 |

| Recording fee | A fee charged by the county to record the deed to the home | $50 to $100 |

| Transfer tax | A tax charged by the state or county on the sale of the home | Varies by state and county |

Transition to main article topics:

FAQs

A comprehensive guide to closing costs can provide Indiana homebuyers with valuable information, but it may not address every specific question or concern. This FAQ section aims to clarify additional common inquiries related to closing costs.

Question 1: How can I negotiate closing costs?

Negotiating closing costs is possible, but it's crucial to approach it strategically. Consider the following tips:

- Research and compare closing costs from multiple lenders.

- Ask for a detailed breakdown of charges and negotiate any excessive or unclear fees.

- Consider offering a larger down payment, which can reduce loan fees and closing costs.

- Inquire about lender credits or incentives that may cover a portion of closing costs.

Real Estate Closing Costs - Rabin Panero & Herrick - Source rphlawyers.com

Question 2: Are closing costs typically paid in cash?

No, closing costs are generally paid with a combination of methods. The most common options include a certified check, wire transfer, or a combination of both. Some lenders may allow you to roll closing costs into your mortgage, which increases your loan amount but potentially reduces upfront expenses.

Question 3: What happens if I can't afford my closing costs?

If you are facing financial challenges and cannot cover closing costs, it's essential to discuss options with your lender. Some lenders may offer assistance programs or down payment assistance grants that can alleviate the costs associated with purchasing a home.

Question 4: Are closing costs taxable?

Yes, certain closing costs, such as loan origination fees, title insurance, and property taxes, are considered deductible mortgage interest and can be itemized on your annual tax return.

Question 5: How can I avoid hidden closing costs?

To avoid hidden closing costs, thoroughly review the loan estimate provided by your lender. This document should outline all charges associated with the loan and closing process. Additionally, ask questions about any fees that seem unclear or excessive.

Question 6: What is a closing disclosure?

A closing disclosure is a standardized form that provides a detailed overview of the loan terms, closing costs, and estimated monthly mortgage payments. This document is required by federal law and must be received at least three business days before closing.

Knowing the answers to these frequently asked questions can empower Indiana homebuyers to make informed decisions throughout the closing process and ensure a smooth and successful closing experience.

Moving forward, the next section will delve into strategies for negotiating lower closing costs.

Tips

Understanding closing cost can be crucial for homebuyers to make informed financial decisions and ensure a smooth settlement process. Here are some essential tips to consider:

Tip 1: Get an Accurate Loan Estimate: Obtain a Loan Estimate (LE) from the lender. The LE provides a detailed breakdown of estimated closing costs, including loan origination fees, title fees, lender fees, and third-party fees. Carefully review the LE and compare it with different lenders to find the most competitive rates and costs.

Tip 2: Negotiate Fees: Some closing costs, such as title insurance premiums, attorney fees, and appraisal fees, may be negotiable. Contact various providers to compare quotes and negotiate the best possible price. However, avoid cutting corners on essential services like title insurance, as they provide crucial protection.

Tip 3: Ask for Seller Concessions: In certain housing markets, sellers may be willing to cover a portion of the closing costs as an incentive for buyers. Explore this option with your real estate agent and negotiate with the seller to reduce your out-of-pocket expenses.

Tip 4: Shop Around for Insurance: Obtain quotes from multiple insurance providers to ensure you're getting the best rates on homeowners insurance and mortgage insurance, if applicable. Don't settle for the insurance offered by the lender; comparing options can lead to significant savings.

Tip 5: Factor in Prepaid Expenses: Closing costs include prepaid expenses such as property taxes, homeowners insurance, and mortgage interest. These expenses cover the period from the closing date until the next billing cycle. Ensure you have sufficient funds to cover these expenses in addition to the closing costs themselves.

Tip 6: Plan for Additional Expenses: Beyond the closing costs outlined in the LE, there may be additional expenses such as moving costs, repairs, or renovations. Factor these into your budget to avoid surprises later on.

Tip 7: Use a Closing Cost Calculator: Online closing cost calculators can provide an estimate of closing costs based on your loan amount, property location, and other factors. Use these tools to get a general idea of the potential costs involved. However, remember that the actual closing costs may vary.

By following these tips and conducting thorough research, homebuyers can better understand and manage closing costs, ensuring a smooth and successful home purchase process.

For further details and a comprehensive guide on closing costs in Indiana, refer to WSBT Closing Costs: A Comprehensive Guide For Indiana Homebuyers.

WSBT Closing Costs: A Comprehensive Guide For Indiana Homebuyers

Prospective homebuyers in Indiana must be well-versed in the essential aspects of WSBT closing costs to ensure a smooth and informed settlement process. These fees, paid at the conclusion of a real estate transaction, cover various expenses associated with the property transfer.

- Lender Fees: Origination charges, underwriting costs, and title insurance.

- Third-Party Fees: Appraisal, home inspection, and property survey.

- Government Fees: Recording fees, transfer taxes, and mortgage recording tax.

- Prepaid Expenses: Homeowners insurance, property taxes, and interest.

- Settlement Costs: Attorney fees, closing fee, and notary fees.

- Negotiable Fees: Lender credits, buyer concessions, and seller-paid closing costs.

Understanding these key aspects empowers homebuyers to effectively budget for closing costs, negotiate favorable terms, and make well-informed decisions. By considering the lender's fees, third-party expenses, government charges, prepaid costs, settlement charges, and negotiable fees, buyers can minimize surprises and ensure a successful home purchase experience.

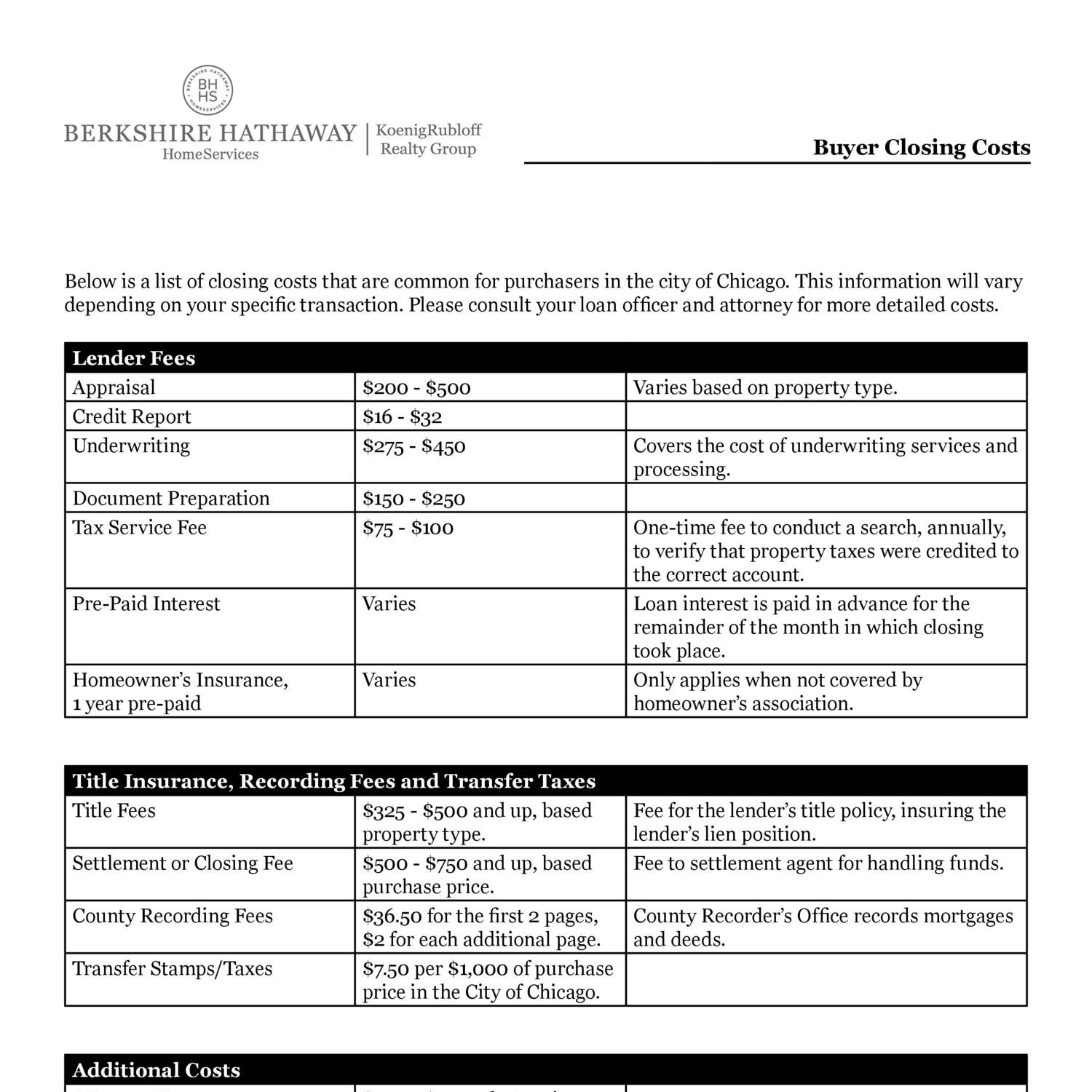

Buyer-Closing-Costs Chicago.pdf | DocDroid - Source www.docdroid.net

WSBT Closing Costs: A Comprehensive Guide For Indiana Homebuyers

WSBT Closing Costs are a vital component for Indiana homebuyers, providing a thorough understanding of the financial costs associated with purchasing a home. These costs, which extend beyond the purchase price, can significantly impact a buyer's budget and overall financial planning. Understanding the nature and importance of closing costs empowers homebuyers to make informed decisions, ensuring a smooth and successful homebuying process.

Closing Costs Explained - Portfolio Realty Group - Source sellsniagara.com

Closing costs typically include fees for services such as title search, loan origination, attorney review, and property taxes. They vary depending on factors like the property's location, loan type, and lender. Understanding these costs allows buyers to anticipate and plan for additional expenses beyond the down payment and mortgage payments. By considering closing costs as part of their overall financial picture, homebuyers can avoid unexpected financial burdens or delays during the closing process.

Overall, WSBT Closing Costs: A Comprehensive Guide For Indiana Homebuyers serves as an invaluable resource for potential homeowners. Its detailed information and practical guidance empower homebuyers with the knowledge and understanding necessary to navigate the closing process confidently, ensuring a successful and informed homebuying journey.

Conclusion

Understanding WSBT Closing Costs is crucial for Indiana homebuyers, enabling them to plan and budget effectively. By recognizing the various components and their impact on the overall homebuying process, buyers can make informed decisions and avoid potential financial pitfalls. This comprehensive guide empowers homebuyers with the knowledge to navigate the closing process confidently, ensuring a successful and stress-free homebuying experience.

As the real estate market continues to evolve, staying informed about closing costs and other financial aspects of homeownership is essential. By embracing a proactive approach and seeking professional guidance when necessary, Indiana homebuyers can make well-informed decisions that align with their financial goals and long-term aspirations.