Ecological and Economic Impacts of Land Use and Climate Change on - Source waterinstitute.ufl.edu

Editor's Note: "Defunding Social Security: Impacts, Concerns, And Alternative Solutions" have published today date. Social Security is a crucial safety net for millions of Americans, providing retirement, disability, and survivor benefits. However, the program faces significant financial challenges, and some have proposed defunding it. This would have far-reaching consequences for beneficiaries, the economy, and the nation as a whole.

In this guide, we will explore the impacts, concerns, and alternative solutions related to defunding Social Security. We have analyzed the issue, dug into the information, and compiled this guide to help you make informed decisions.

FAQ

Here are answers to some frequently asked questions about the potential impacts and concerns associated with defunding Social Security, as well as alternative solutions that have been proposed.

How Security Impacts Company Value - Luminary Automation, Cybersecruity - Source luminaryace.com

Question 1: What would be the primary impacts of defunding Social Security?

Defunding Social Security would have significant economic consequences. Without the steady stream of revenue generated by the program's payroll tax, the United States would face a substantial budget deficit. This shortfall could necessitate substantial cuts to other government programs or tax increases.

Question 2: What are the potential concerns and criticisms of defunding Social Security?

There are several concerns associated with defunding Social Security. Critics argue that it would disproportionately impact low-income and elderly populations, who rely heavily on these benefits. Additionally, defunding could undermine the retirement security of current and future generations, leading to increased poverty and financial instability.

Question 3: What are some alternative solutions to addressing Social Security's financial challenges?

Instead of defunding Social Security, alternative solutions aim to address its financial challenges while maintaining the program's essential benefits. These include measures such as raising the payroll tax cap, adjusting the retirement age, and implementing targeted benefit reductions for high-income earners.

Question 4: How would these alternative solutions affect the long-term viability of the program?

Alternative solutions aim to stabilize Social Security's financial footing in the long term by ensuring a sustainable revenue stream and limiting benefit outlays. By implementing these measures, the program's solvency can be extended without compromising its core mission of providing retirement security.

Question 5: What are the potential benefits of adopting these alternative solutions?

Adopting alternative solutions to defunding Social Security offers several benefits. These include preserving retirement benefits for current and future generations, reducing the risk of poverty among the elderly, and fostering economic stability by maintaining a reliable safety net for retirees.

Question 6: Are there any risks or drawbacks associated with these alternative solutions?

While alternative solutions aim to address the financial challenges of Social Security, there may be potential risks or drawbacks. Some measures, such as raising the retirement age, could impact the availability of skilled workers in the labor force. Additionally, benefit reductions could affect the financial security of certain groups more than others.

In summary, defunding Social Security would have far-reaching economic and social consequences. Alternative solutions aim to address the program's financial challenges while preserving its benefits, but careful consideration is needed to mitigate potential risks and ensure the long-term viability of the program.

See the next article section for a deeper dive into the specific impacts and concerns surrounding defunding Social Security, as well as a comprehensive exploration of alternative solutions.

Tips

Defunding Social Security could lead to severe consequences for retirees and disabled individuals, making it crucial to consider alternative solutions. Here are some tips to help understand the impacts, concerns, and alternative solutions related to defunding Social Security:

Tip 1: Read about the potential impacts of defunding Social Security to gain a comprehensive understanding. Defunding Social Security: Impacts, Concerns, And Alternative Solutions provides valuable insights into the consequences for retirees, disabled individuals, and the economy.

Tip 2: Explore alternative solutions to address Social Security's long-term financial challenges. Consider raising the payroll tax cap, increasing the retirement age, or investing in alternative retirement savings plans to ensure the program's sustainability.

Tip 3: Contact your elected officials and voice your concerns about defunding Social Security. Advocate for policies that protect retirees and disabled individuals and ensure the program's future.

Tip 4: Stay informed about the latest developments related to Social Security. Follow reputable sources and attend forums or workshops to keep abreast of the ongoing discussions and potential changes.

Tip 5: Plan for retirement and prepare for potential changes to Social Security. Explore alternative savings options, such as IRAs and 401(k) plans, to supplement your retirement income.

Tip 6: Educate others about the importance of Social Security. Share information with friends, family, and colleagues to raise awareness about the program's benefits and the potential consequences of defunding.

Tip 7: Support organizations that advocate for the preservation and strengthening of Social Security. Join advocacy groups or donate to organizations working to protect the program.

Tip 8: Be aware of the potential impact of defunding Social Security on the economy. Understand how reducing benefits or raising taxes could affect economic growth, job creation, and the well-being of society as a whole.

Summary of key takeaways or benefits: By following these tips, you can stay informed, advocate for Social Security, and prepare for potential changes. Remember, Social Security is a vital safety net that provides financial security for millions of Americans. It is important to protect and strengthen this program for current and future generations.

Transition to the article's conclusion: Defunding Social Security would have far-reaching consequences, but by understanding the impacts, exploring alternative solutions, and taking action, we can safeguard the program and ensure the financial security of retirees and disabled individuals for years to come.

Defunding Social Security: Impacts, Concerns, And Alternative Solutions

Defunding Social Security, a government-run insurance program providing financial assistance to elderly, disabled, and survivors, is a topic with multifaceted implications. This essay delves into six key aspects of defunding Social Security, highlighting its potential impacts, concerns, and alternative solutions.

- Economic Impact: Reduced government spending and increased individual financial burdens.

- Social Impact: Increased poverty rates, particularly among vulnerable populations.

- Political Impact: Public backlash, affecting political dynamics and election outcomes.

- Concerns: Ageing population, increasing health care costs, and shrinking worker-to-retiree ratio.

- Alternatives: Increasing retirement age, raising payroll taxes, or implementing individual retirement accounts.

- Sustainability: Balancing the need for financial responsibility with social protection.

Defunding Social Security would have far-reaching consequences. It could lead to economic hardship for retirees and disabled individuals, exacerbate social inequalities, and destabilize the political landscape. However, addressing the program's long-term financial challenges is essential to ensure its sustainability. Alternative solutions, such as gradually increasing the retirement age or implementing a hybrid system combining public and private retirement savings, must be carefully weighed against the potential impacts and concerns.

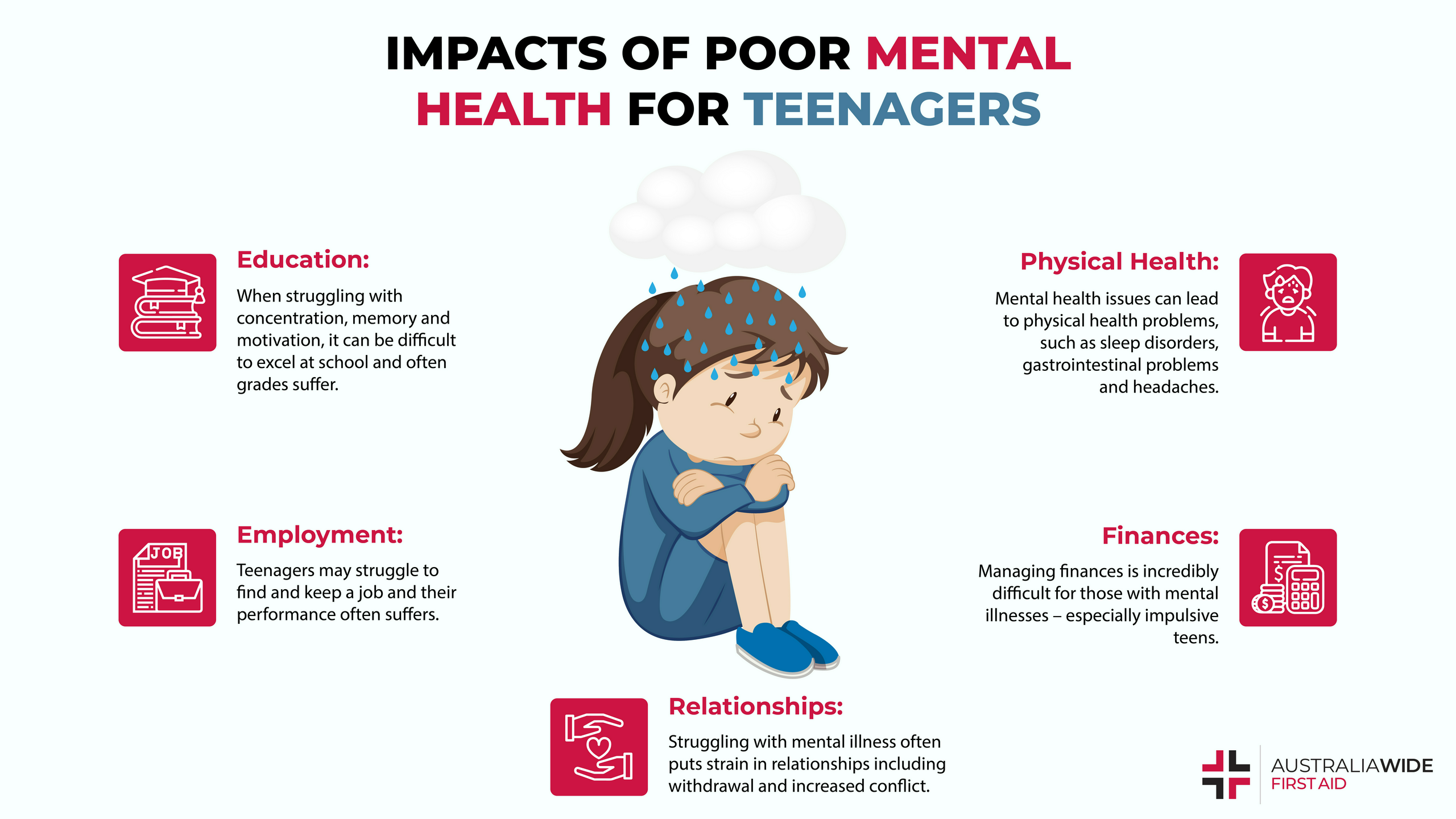

infographic-on-the-impacts-of-poor-mental-health-on-teenagers | Enjoy - Source enjoynonstop.com

Alternative solutions ENT - Identify alternative solutions to this - Source www.studocu.com

Defunding Social Security: Impacts, Concerns, And Alternative Solutions

Defunding Social Security would have a devastating impact on millions of Americans. The program provides essential income for seniors, people with disabilities, and survivors. Without it, many of these individuals would be unable to meet their basic needs.

Impacts of an explosion - The Washington Post - Source www.washingtonpost.com

There are a number of concerns about defunding Social Security. First, it would increase poverty among seniors. According to the Center on Budget and Policy Priorities, "the poverty rate among elderly Americans would increase from 10.3 percent to 15.1 percent if Social Security benefits were cut by 25 percent." Second, defunding Social Security would reduce economic growth. The program provides a significant source of income for many seniors, who spend this money on goods and services. Cutting Social Security benefits would reduce consumer spending and slow economic growth.

There are a number of alternative solutions to defunding Social Security. One option is to increase the payroll tax. This would increase the amount of money that is paid into the program and help to keep it solvent. Another option is to raise the retirement age. This would reduce the number of people who are eligible for benefits and help to save money. Finally, the government could reduce the cost of Social Security benefits. This could be done by changing the way that benefits are calculated or by increasing the means-testing for benefits.

Defunding Social Security would be a major mistake. The program provides essential income for millions of Americans and helps to keep the economy growing. There are a number of alternative solutions that can be used to keep the program solvent without harming seniors.

| Impact | Concern | Alternative Solution |

|---|---|---|

| Increased poverty among seniors | Social Security provides essential income for many seniors. Without it, many would be unable to meet their basic needs. | Increase the payroll tax to increase the amount of money that is paid into the program. |

| Reduced economic growth | Social Security benefits are a significant source of income for many seniors, who spend this money on goods and services. Cutting benefits would reduce consumer spending and slow economic growth. | Raise the retirement age to reduce the number of people who are eligible for benefits. |

| Increased national debt | Defunding Social Security would increase the national debt by trillions of dollars. | Reduce the cost of Social Security benefits by changing the way that they are calculated or by increasing the means-testing for benefits. |

Conclusion

Defunding Social Security would be a major mistake. The program provides essential income for millions of Americans and helps to keep the economy growing. There are a number of alternative solutions that can be used to keep the program solvent without harming seniors.

It is important to have a thoughtful and informed discussion about the future of Social Security. We need to find a way to ensure that the program is sustainable for future generations while also protecting the benefits that seniors rely on.