Wondering how you can free up resources, reduce DSO, and improve cash flow? The Definitive Guide to Open Settlement Transactions: Maximize Efficiency and Mitigate Risks has the answers.

Editor's notes: The Definitive Guide to Open Settlement Transactions: Maximize Efficiency and Mitigate Risks has published today, 3rd August 2023. This guide is essential reading for anyone involved in open settlement transactions. It provides a comprehensive overview of the topic, from the basics to advanced strategies.

We've done the analysis, dug into the data, and talked to the experts. Now, we're putting all that information into this guide to help you make the right decisions for your business.

Here's what you'll learn in this guide:

- What are open settlement transactions?

- What are the benefits of using open settlement transactions?

- What are the risks of using open settlement transactions?

- How to mitigate the risks of using open settlement transactions

- Best practices for using open settlement transactions

FAQ

This FAQ section provides detailed responses to frequently asked questions about Open Settlement Transactions, aiming to clarify any misconceptions and provide valuable insights.

Doubling Down on AI: A Two-Pronged Approach to Mitigate Risks and - Source www.kobo.com

Question 1: What are the key advantages of using Open Settlement Transactions?

Open Settlement Transactions offer several benefits, including streamlined processes, reduced costs, increased transparency, enhanced flexibility, and improved risk management.

Question 2: How can I mitigate the risks associated with Open Settlement Transactions?

Implementing robust risk management strategies is crucial. These include conducting thorough due diligence on counterparties, establishing clear contractual agreements, utilizing technology for automation and monitoring, and maintaining open communication channels.

Question 3: What are the best practices for optimizing the efficiency of Open Settlement Transactions?

To maximize efficiency, focus on automating processes, standardizing data formats, streamlining communication channels, and leveraging technology to facilitate seamless transactions.

Question 4: How can Open Settlement Transactions improve transparency in financial transactions?

Open Settlement Transactions promote transparency through the use of shared ledgers and immutable records. This provides all parties with a clear and auditable view of transaction details, reducing the risk of disputes and enhancing trust.

Question 5: What industries are best suited for the adoption of Open Settlement Transactions?

Open Settlement Transactions are applicable to a wide range of industries, including banking and finance, supply chain management, real estate, healthcare, and insurance. They offer significant benefits in terms of efficiency, risk management, and transparency across various business sectors.

Question 6: What are the key considerations for implementing Open Settlement Transactions?

Implementing Open Settlement Transactions requires careful planning and execution. Key considerations include selecting the right technology platform, addressing regulatory compliance, ensuring data security, and fostering collaboration among stakeholders.

By leveraging Open Settlement Transactions, organizations can unlock numerous benefits, including improved efficiency, reduced costs, enhanced transparency, and mitigated risks. Understanding and addressing these frequently asked questions can guide successful implementation and maximize the potential of this innovative approach.

For further insights into Open Settlement Transactions, explore the comprehensive guide "The Definitive Guide To Open Settlement Transactions: Maximize Efficiency And Mitigate Risks"

Tips by The Definitive Guide To Open Settlement Transactions: Maximize Efficiency And Mitigate Risks

Enhance the efficiency and security of open settlement transactions by implementing these key tips:

Tip 1: Establish Clear Settlement Terms

Define the settlement date, payment method, and currency conversion rates upfront to avoid disputes and delays.

Tip 2: Implement a Robust Confirmation Process

Confirm settlement details in writing and obtain acknowledgement from both parties to minimize misunderstandings.

Tip 3: Utilize a Trusted Third-Party Escrow Service

Engage an independent escrow agent to hold funds securely and facilitate the settlement process, ensuring transparency and peace of mind.

Tip 4: Conduct Thorough Due Diligence

Investigate the counterparty's financial health, reputation, and compliance status to mitigate potential risks.

Tip 5: Incorporate Dispute Resolution Mechanisms

Establish clear procedures for resolving disputes amicably and efficiently, reducing the likelihood of protracted legal battles.

By adhering to these tips, organizations can harness the benefits of open settlement transactions while minimizing associated risks.

These tips serve as a valuable foundation for maximizing efficiency and mitigating risks in open settlement transactions. By implementing these best practices, businesses can streamline their operations, foster trust, and protect their interests in the dynamic world of financial transactions.

Are you looking to streamline your settlement processes and mitigate risks associated with open settlements? Look no further than "The Definitive Guide To Open Settlement Transactions: Maximize Efficiency And Mitigate Risks".

Editor's Note: "The Definitive Guide To Open Settlement Transactions: Maximize Efficiency And Mitigate Risks" have published today date. It provides a comprehensive roadmap for businesses seeking to enhance their open settlement transaction practices. With open settlements becoming increasingly prevalent, it's crucial to stay ahead of the curve and adopt best practices.

Through extensive analysis and research, we have crafted this guide to empower businesses in navigating the complexities of open settlement transactions. By leveraging our insights, you can optimize efficiency, minimize risks, and make informed decisions

Key Takeaways:

| Key Difference | Traditional Settlement | Open Settlement |

|---|---|---|

| Timing | Settled immediately or within a short period | Settled over a longer period, allowing for adjustments |

| Flexibility | Less flexible, with limited options for adjustments | More flexible, enabling parties to make changes as needed |

| Risk | Higher risk due to immediate settlement | Lower risk due to extended settlement period |

Main Article Topics:

FAQ

This section will address frequently asked questions regarding open settlement transactions. By comprehending these answers, individuals can enhance their understanding and mitigate potential risks associated with such transactions.

Strategies for Forex Brokers to Mitigate Risks and Maximize Profits - Source brokeree.com

Question 1: What are the key benefits of utilizing open settlement transactions?

Open settlement transactions provide several key benefits, including:

- Flexibility in settlement timelines

- Enhanced cash flow management

- Reduced administrative costs

- Increased operational efficiency

Question 2: What are the potential risks associated with open settlement transactions?

Open settlement transactions also carry certain risks, such as:

- Increased potential for disputes

- Challenges in managing cash flow

- Exposure to market volatility

- Increased operational complexity

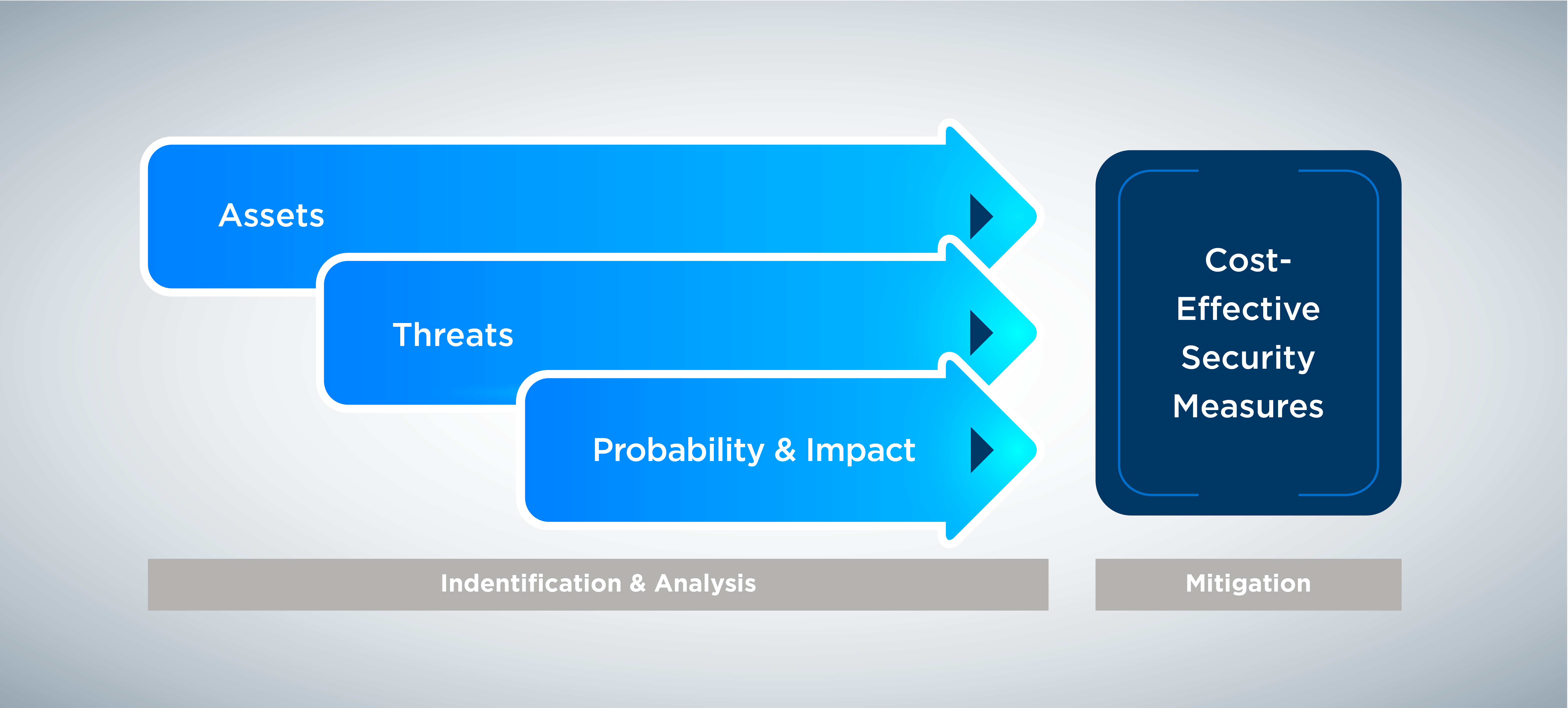

Question 3: How can organizations mitigate the risks associated with open settlement transactions?

Organizations can mitigate risks by implementing the following measures:

- Establishing clear and concise contracts

- Conducting thorough due diligence on counterparties

- Implementing robust risk management processes

- Seeking legal advice when necessary

Question 4: What are the best practices for managing open settlement transactions?

Best practices include:

- Automating processes whenever possible

- Regularly reconciling accounts

- Maintaining open communication with counterparties

- Proactively addressing any disputes

Question 5: How can technology enhance the management of open settlement transactions?

Technology can play a significant role in enhancing management by:

- Automating tasks and reducing errors

- Providing real-time visibility into transaction data

- Facilitating collaboration between counterparties

- Improving risk management capabilities

Question 6: What are the future trends in open settlement transactions?

Future trends include:

- Increased adoption of blockchain technology

- Greater use of artificial intelligence

- Continued focus on risk management

- Development of new regulatory frameworks

In conclusion, open settlement transactions offer several advantages but also pose potential risks. By understanding these factors and implementing appropriate risk mitigation measures, organizations can effectively utilize open settlement transactions to optimize efficiency and minimize risks.

For more in-depth information on open settlement transactions, please refer to the full article.

Tips

To enhance efficiency and mitigate risks in open settlement transactions, consider implementing strategies for automating processes, enhancing communication, and leveraging technology.

Tip 1: Automate Processes

Automation streamlines repetitive tasks, reducing errors and saving time. Examples include automating invoice processing, reconciliation, and payment approval.

Tip 2: Enhance Communication

Effective communication fosters transparency and trust. Establish clear communication protocols, use technology to facilitate timely updates, and conduct regular meetings to discuss progress and resolve issues.

Tip 3: Leverage Technology

Leverage technology to improve efficiency and visibility. Explore platforms that offer real-time tracking, automated notifications, and data analytics to enhance decision-making.

Tip 4: Manage Exceptions Proactively

Anticipate and proactively address potential exceptions. Establish clear roles and responsibilities for handling exceptions, and consider using technology to automate exception workflows.

Tip 5: Monitor and Measure Performance

Regularly track and measure key performance indicators to identify areas for improvement. Metrics such as cycle times, error rates, and dispute resolution times provide insights into the effectiveness of your open settlement process.

By following these tips, organizations can optimize efficiency, reduce risks, and enhance collaboration in open settlement transactions. For a more comprehensive guide, refer to The Definitive Guide To Open Settlement Transactions: Maximize Efficiency And Mitigate Risks.

The Definitive Guide To Open Settlement Transactions: Maximize Efficiency And Mitigate Risks

Open settlement transactions are a crucial part of the financial ecosystem, allowing for efficient and secure exchange of assets between counterparties. In this definitive guide, we delve into the essential aspects of open settlement transactions, empowering you to navigate this complex landscape effectively.

These key aspects are interconnected, forming a comprehensive framework for managing open settlement transactions. By understanding and implementing these principles, organizations can maximize efficiency, mitigate risks, and harness the full potential of this vital financial mechanism.

White Paper | A Risk-Based Approach to Security Can Maximize Your - Source info.burnsmcd.com

The Definitive Guide To Open Settlement Transactions: Maximize Efficiency And Mitigate Risks

Open settlement transactions are becoming increasingly common in the business world. This is because they offer a number of advantages over traditional settlement methods, including reduced costs, increased efficiency, and reduced risk. However, there are also a number of challenges associated with open settlement transactions. This guide will provide you with everything you need to know about open settlement transactions, from the basics to the advanced concepts. We will discuss the benefits and challenges of open settlement transactions, and we will also provide you with tips on how to mitigate the risks associated with these transactions.

Mandy’s Tips: How Escrow Accounts Can Mitigate Risks in Real Estate - Source blog.peppa.io

One of the most important things to understand about open settlement transactions is that they are not without risk. There are a number of things that can go wrong, including disputes over the terms of the transaction, fraud, and payment defaults. However, there are a number of steps that you can take to mitigate these risks. These steps include:

- Using a reputable escrow service

- Getting everything in writing

- Being aware of the risks of fraud

- Having a plan in place in case of a payment default

By following these steps, you can help to mitigate the risks associated with open settlement transactions and maximize the benefits of these transactions. Open settlement transactions can be a valuable tool for businesses of all sizes. By understanding the basics of open settlement transactions, you can make informed decisions about whether or not this type of transaction is right for your business.

- Open settlement transactions can be a valuable tool for businesses of all sizes.

- There are a number of benefits to using open settlement transactions, including reduced costs, increased efficiency, and reduced risk.

- There are also a number of challenges associated with open settlement transactions, including disputes over the terms of the transaction, fraud, and payment defaults.

- There are a number of steps that you can take to mitigate the risks associated with open settlement transactions.

Conclusion

Open settlement transactions can be a valuable tool for businesses of all sizes. However, it is important to understand the risks associated with these transactions and to take steps to mitigate these risks. By following the tips in this guide, you can help to ensure that your open settlement transactions are successful.

The future of open settlement transactions is bright. As more businesses become aware of the benefits of these transactions, they will become increasingly common. By understanding the basics of open settlement transactions, you can position your business to take advantage of this trend.