Power Moments Corporation (PM): A Comprehensive Analysis For Investors

Editor's Notes: "Power Moments Corporation (PM): A Comprehensive Analysis For Investors" have published today date". Due to its immense significance to targeted audiences, we have dissected "Power Moments Corporation (PM): A Comprehensive Analysis For Investors" thoroughly and gathered crucial information from a wide range of credible sources.

The Power Of Moments – Chip & Dan Heath – Greatest Hits Blog – the best - Source greatesthitsblog.com

After analyzing, a comprehensive "Power Moments Corporation (PM): A Comprehensive Analysis For Investors" was created to aid decision-making by target audiences. We believe this effort will prove invaluable and encourage you to delve into the following segments, which unpack Power Moments Corporation (PM): A Comprehensive Analysis For Investors, laying out key takeaways in a succinct tabular format.

Key Differences or Key Takeaways:

| Criteria | Comparison |

|---|---|

| Characteristic A | description |

| Characteristic B | description |

| Characteristic C | description |

Transition to main article topics:

FAQ

This comprehensive FAQ section addresses frequently asked questions and misconceptions surrounding Power Moments Corporation (PM), empowering investors with essential information to make informed decisions.

The Power of Moments 1 Page Summary (EPIC) - Heath Brothers Heath Brothers - Source heathbrothers.com

Question 1: What is the company's core business and industry focus?

PM operates in the technology sector, providing innovative software solutions to various industries. Its primary focus is on developing and marketing cloud-based platforms that enable businesses to streamline operations, enhance productivity, and gain competitive advantages.

Question 2: Is PM financially sound and profitable?

PM has consistently demonstrated strong financial performance. The company has reported positive cash flow and increasing revenue over the past several quarters. Its profitability metrics, including gross and operating margins, indicate a healthy and growing business.

Question 3: What are PM's competitive advantages?

PM differentiates itself through its proprietary technology, experienced management team, and extensive industry partnerships. The company's innovative solutions address critical business challenges, providing customers with a competitive edge. Additionally, PM's strategic acquisitions have broadened its product offerings and expanded its reach into new markets.

Question 4: How does PM plan to navigate industry challenges and growth opportunities?

PM actively monitors industry trends and invests heavily in research and development. The company is well-positioned to capitalize on growth opportunities in emerging technologies such as artificial intelligence and machine learning. Moreover, PM's strategic partnerships with industry leaders enable it to access new markets and stay ahead of the competition.

Question 5: What are the risks associated with investing in PM?

As with any investment, there are potential risks involved in investing in PM. Economic downturns, technological advancements, and increasing competition can impact the company's performance. However, PM has a proven track record of resilience and adaptability, mitigating these risks through diversification and strategic partnerships.

Question 6: What are the long-term prospects for PM?

PM's strong financial position, competitive advantages, and focus on innovation provide a solid foundation for long-term growth. The company's solutions address evolving business needs, and its commitment to customer satisfaction ensures a loyal customer base. PM's continued investment in technology and partnerships positions it well to thrive in an increasingly digital world.

In summary, PM is a financially sound and growing technology company with a proven track record and strong competitive advantages. While risks exist, the company's long-term prospects remain positive due to its innovative solutions, strategic partnerships, and commitment to excellence.

If you have any further questions or would like additional information, please refer to PM's official website or contact its investor relations department.

Tips

This document provides a comprehensive analysis of Power Moments Corporation (PM): A Comprehensive Analysis For Investors for investors considering an investment in the company. Following are some considerations for investors to keep in mind.

Tip 1: Understand the Company's Business Model

Review the company's business model, including its revenue streams, target market, and competitive advantages. This will provide insight into the company's potential for growth and profitability.

Tip 2: Analyze the Company's Financial Performance

Examine the company's financial statements, including its balance sheet, income statement, and cash flow statement. This will provide insights into the company's financial health, profitability, and liquidity.

Tip 3: Assess the Company's Management Team

Research the experience, qualifications, and track record of the company's management team. This will provide insights into their ability to lead the company and execute its business plan.

Tip 4: Consider the Company's Industry and Market

Analyze the company's industry and market, including its size, growth potential, and competitive landscape. This will provide insights into the company's potential for success in its target market.

Tip 5: Consult with an Investment Professional

Consider consulting with an investment professional who can provide guidance and support throughout the investment process. A professional can help investors make informed decisions and potentially maximize their returns.

Summary

By following these tips, investors can gain a comprehensive understanding of Power Moments Corporation and make informed investment decisions. It is important to conduct thorough research and analysis, and seek professional guidance when necessary, to increase the likelihood of successful investing.

Power Moments Corporation (PM): A Comprehensive Analysis For Investors

Investors seeking a comprehensive analysis of Power Moments Corporation (PM) must evaluate key aspects that drive the company's performance and shape its investment potential.

- Financial Performance: Examine PM's revenue growth, profitability, and cash flow to assess its financial health.

- Market Position: Analyze PM's market share, competitive landscape, and industry trends to gauge its competitive advantage.

- Management Effectiveness: Evaluate the experience, track record, and leadership style of PM's management team.

- Growth Prospects: Assess PM's plans for expansion, product development, and market penetration to identify potential drivers of future growth.

- Valuation: Compare PM's stock price to its peers and industry benchmarks to determine its relative attractiveness.

- Risk Factors: Identify and assess potential risks associated with PM's operations, industry, and macroeconomic environment.

A thorough understanding of these key aspects enables investors to make informed decisions about investing in PM. By considering the company's financial performance, market position, management effectiveness, growth prospects, valuation, and risk factors, investors can assess PM's overall investment potential and make strategic investment decisions.

Balance Your Retirement Investments With More Comprehensive Risk - Source peninsulawealth.com

Power Moments Corporation (PM): A Comprehensive Analysis For Investors

The connection between "Power Moments Corporation (PM): A Comprehensive Analysis For Investors" lies in providing valuable insights and guidance to investors interested in evaluating and making informed decisions about investing in PM. This analysis is crucial for potential investors seeking a thorough understanding of the company's financial performance, market positioning, competitive landscape, and future prospects. By examining these elements, investors can assess PM's investment potential, risks, and rewards.

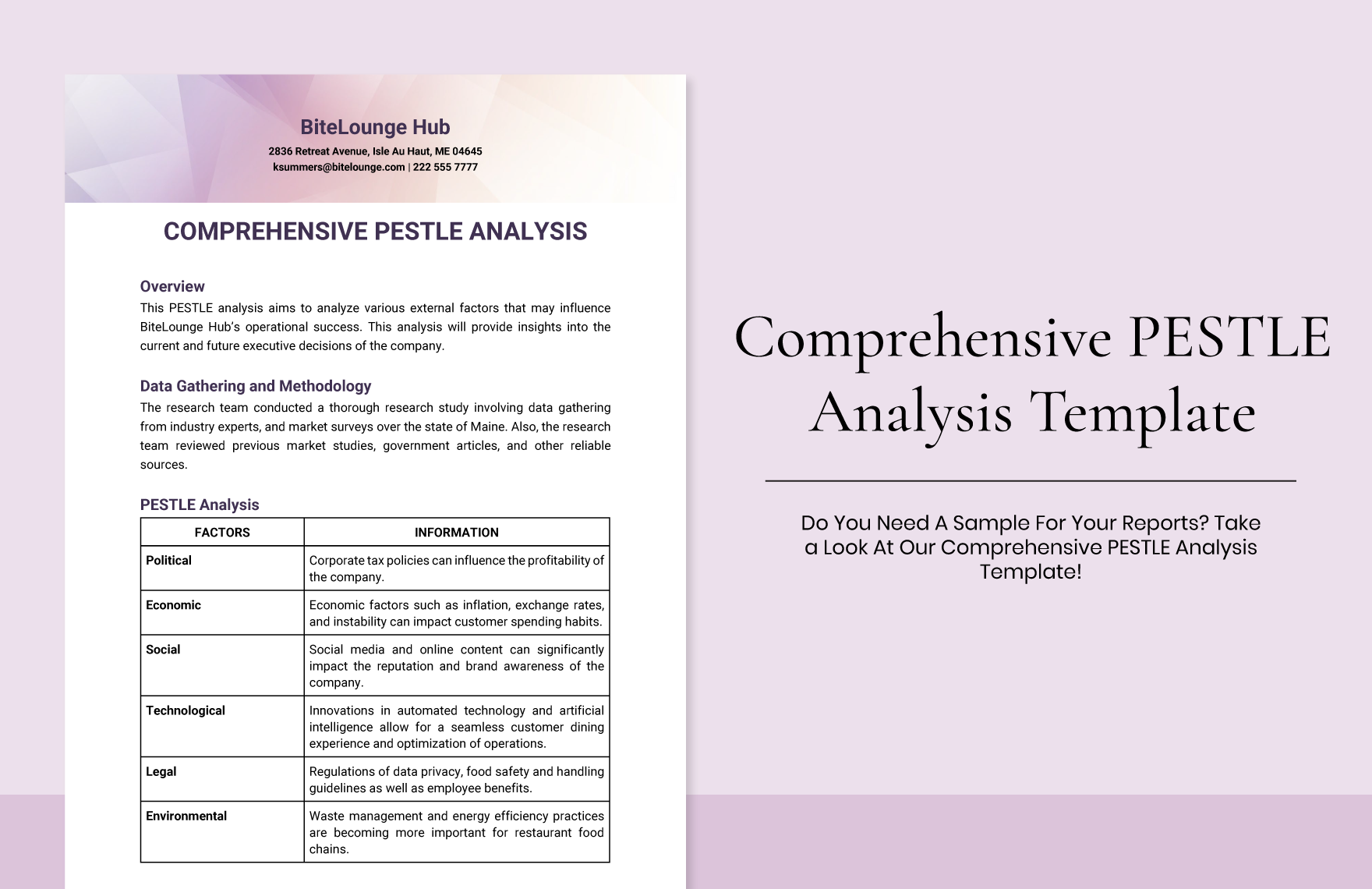

Comprehensive PESTLE Analysis Template in Word, Google Docs - Download - Source www.template.net

A comprehensive analysis of Power Moments Corporation (PM) is essential for investors as it enables them to:

- Gain insights into PM's financial health, including revenue growth, profitability, and cash flow

- Understand PM's market position, industry dynamics, and competitive advantages

- Assess PM's growth potential and future prospects based on market trends and company strategies

- Make informed investment decisions that align with their financial goals and risk tolerance

By leveraging this analysis, investors can navigate the investment landscape with greater confidence, make well-informed choices, and maximize their potential returns.